Achieving Sustainability

Why carbon markets matter to sustainable equity investors

With the current strong focus on climate, sustainability, and the energy transition, one might have expected the price of carbon emissions to increase steadily. Instead, we have seen a broadly declining trend since a peak in 2022. This can be attributed to several factors. First, the energy crisis resulting from the Russian invasion of Ukraine in early-2022 led to a strong and unexpected switch away from higher emitting forms of energy and a renewed focus on energy efficiency. Second, alongside this switch, we have seen sluggish economic growth, further impacting demand and increasing the availability of natural gas, while also lowering the demand for carbon emission credits.

From an equity investment perspective, while these swings in the price of carbon are not yet having a material effect on specific sectors, they do provide us with a framework to assess where any future elevated carbon pricing might have an impact. For instance, the demand for heat pumps in Europe soared as governments and consumers rushed to secure supply at higher carbon prices, and this has now abated with a substantial decline in demand from the peaks.

Carbon market dynamics

The traditional starting point for considering the dynamics of carbon markets is to take the perspective of a polluting company. Here, what the carbon price should tell us is the cost of an additional unit of production in terms of having to mitigate its emissions. This way of thinking about carbon prices is currently the standard across many industries.

A further way of considering carbon prices is in terms of the social cost of carbon output, i.e. the price of carbon that is required to achieve a particular outcome in terms of an expected increase in global warming. For instance, if we are considering an investment in infrastructure aimed at producing and accommodating more renewable energy, the long run effects of this investment will be lower emissions. We thus require some form of cost-benefit analysis to evaluate the emissions we’re going to produce developing this infrastructure.

A third way of considering carbon prices is in terms of supply and demand, and the influence politics has on them. For instance, there was an uptick in issued allowances in 2023 to finance the REPowerEU scheme, designed to end European reliance on Russian fossil fuels by 2030. Yet, from a supply perspective, despite a level of political uncertainty, the trend is clearly one of tightening supply in the future.

Translating carbon market insights into equity investment opportunities

Considering the carbon market in these various ways allows us to model the price of carbon based on several key factors, including the level of economic growth, predicted renewables output, expected demand from industry, and the expected supply of emissions credits from regulators. And these models can then be applied across our investment universes to consider companies that may be outliers in terms of the opportunities or threats they face due to progressing decarbonization and the accelerating energy transition.

We also like to look at the carbon market is in terms of providers that are supplying products and solutions into areas which are growing structurally. A good example is cooling: the world is clearly getting hotter, and demand for air conditioning and food storage solutions will continue growing. Indeed, cooling receives a great deal of attention as the climate situation is creating a negative feedback loop: the warmer it gets, the more we need to cool, and we often do so by burning fuel to run air conditioning and refrigeration units. This means the search for more efficient cooling, more energy efficient buildings that require less cooling, and so on, is imperative. The leading players in this area are thus very interesting from an investment perspective. And this approach can, of course, be applied to other areas where innovative firms are catering for demands that are set to grow structurally over the coming years and decades.

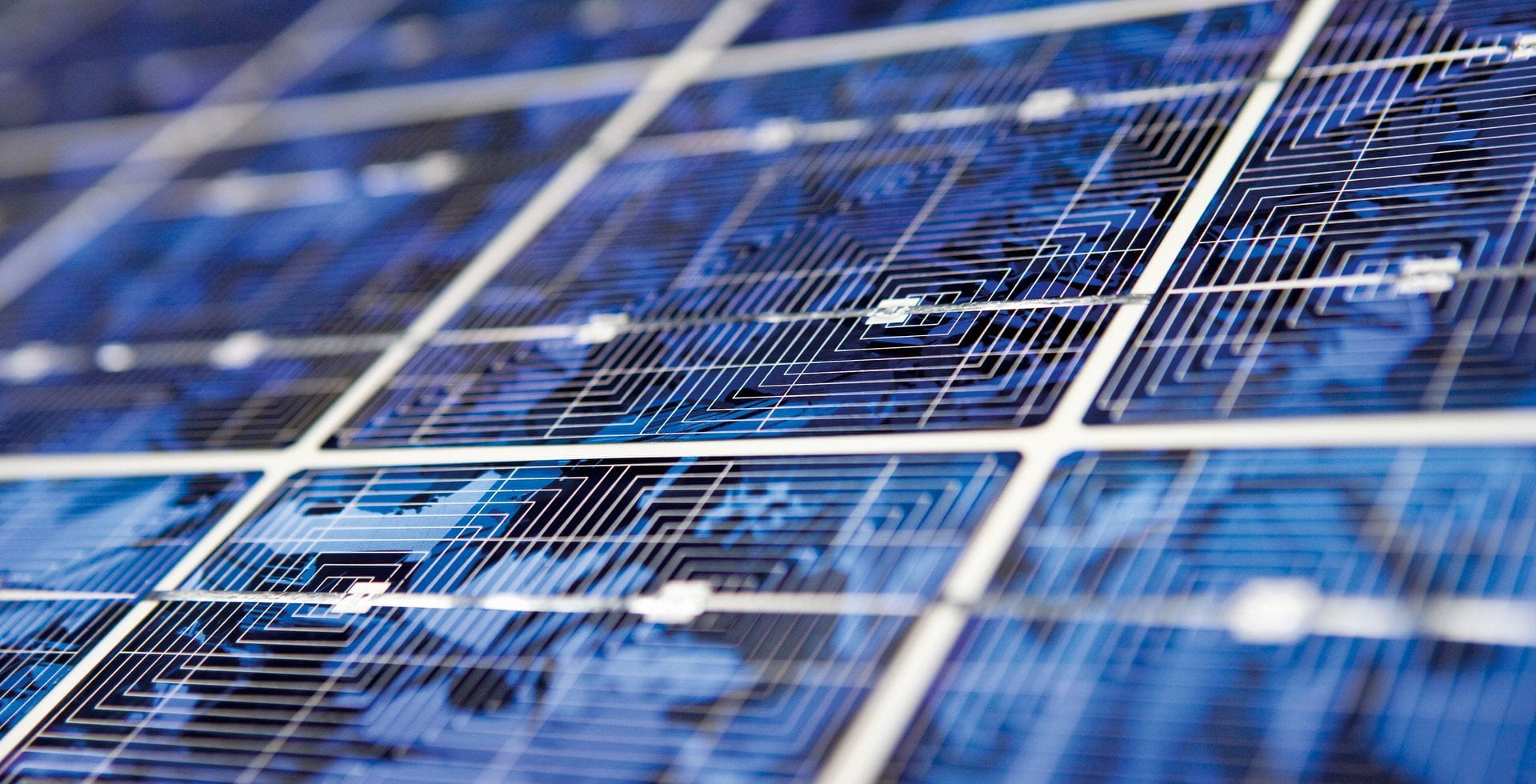

A further consideration for investors is their portfolio’s level of exposure to carbon prices. For instance, utility companies – especially ones that don’t have a high carbon cost, such as hydroelectric, wind, or solar providers – benefit from periods of high carbon prices.

Geopolitical risk and carbon prices, or: what does cognac have to do with carbon?

Finally, as already mentioned, carbon is a market that owes its creation to, and remains highly dependent on, regulatory intervention. Looking forward, the EU’s Carbon Border Adjustment Mechanism (CBAM) will be introduced in 2027 to tax carbon-intensive products coming into the EU. Of course, current modelling of carbon prices already embraces such foreseeable policy changes, but investors should nevertheless remain wary of the possibly unintended consequences of regulatory and government intervention in this market – and on trade more generally.

For instance, President Biden’s shock announcement of tariffs of up to 100% on Chinese EVs firmly put the energy transition within scope of the US-China trade conflict. As China will be one of the main trade partners affected by CBAM, and with the European Union mulling its own version of tariffs on China’s EVs, tit-for-tat retaliation cannot be excluded, and may affect seemingly unrelated products such as the large quantities of luxury goods, from highend cognac to sports cars, that China imports from France and Germany.