Investing in the future of European renewable energies

Summary

Europe’s renewable energy industry is a dynamic infrastructure market that has evolved over almost a quarter of a century. The sector has grown from a dependence upon government support policies, designed to springboard the various technologies, to standalone independent business models that, in many cases, no longer need any state intervention whatsoever.¹ The renewable energy market has become a mature and sustainable business.

|

Key takeaways

|

Many of the first investors in the European renewable energy market were pension funds and other institutional investors looking to match long-term annuity obligations to stable and predictable cash flows with low or no correlation to other capital markets. Such a profile can still be found today albeit the market landscape has changed.

Today, as more capital in the renewable sector is flowing to traditional operational assets, investors are exploring opportunities across different sub-sectors of the renewable energy space, moving up the project value chain, in order to maintain the same return level.

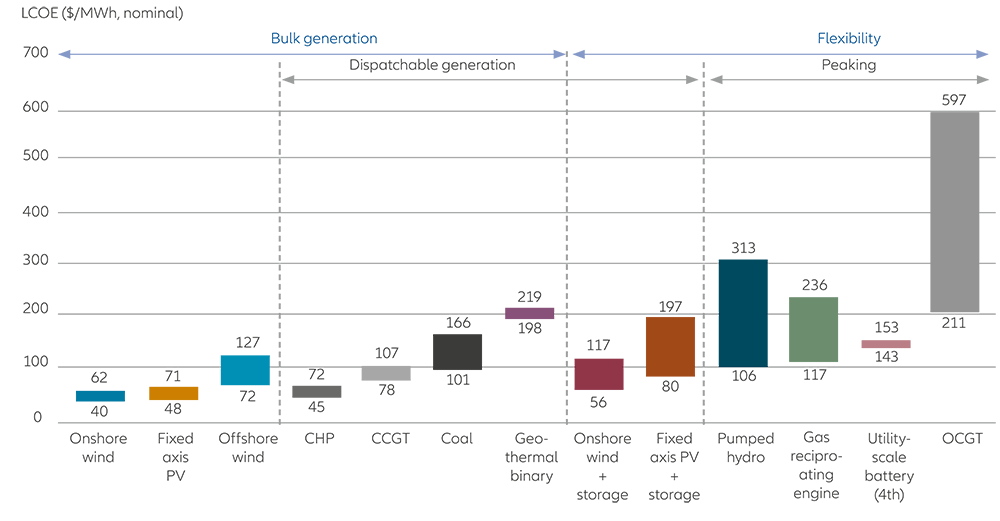

Thanks to increasing efficiencies in construction and technological advances, the cost of providing renewable energy has dropped dramatically. Solar and onshore wind power are now both as competitive as traditional power generation.2

Source: BloombergNEF. Note: The LCO range represents a range of costs and capacity factors. Battery storage systems (co-located and stand-alone) presented here have a four-hour storage. In case of solar- and wind-plus-battery systems, the range is a combination of capacity factors and size of the battery relative to the power generating asset (25% to 100% of total installed capacity). All LCOE calculations are unsubsidised and exclude curtailment. Categorisation of technologies is based on their primary use case.

The development of a healthy purchase power agreement (PPA) market is another indication that alternative revenue structures to feed-in tariffs and subsidy mechanisms can also attract new investment in the sector.

In this paper, we look at some of the changes that the European renewable market is going through and why these changes make Europe one of the best regions for investing in renewable energy. We also discuss the different opportunities available to investors in this changing market environment.

|

|

Download full whitepaper here |

1 Irfan, U. (2018). Europe is building more wind and solar — without any subsidies. Vox. Retrieved April 29, 2020, from https://www.vox.com/2018/5/30/17408602/solar-wind-energy-renewable-subsidy-europe

2 Gray, M., & Sundaresan., S. (March 2020). How to waste over half a trillion dollars: the economic implications of deflationary renewa- ble energy from coal power investments, pp. 5, 9-10, 18-19. Carbon Tracker Initiative.

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested. Investing in fixed income instruments may expose investors to various risks, including but not limited to creditworthiness, interest rate, liquidity and restricted flexibility risks. Changes to the economic environment and market conditions may affect these risks, resulting in an adverse effect to the value of the investment. During periods of rising nominal interest rates, the values of fixed income instruments (including short positions with respect to fixed income instruments) are generally expected to decline. Conversely, during periods of declining interest rates, the values of these instruments are generally expected to rise. Liquidity risk may possibly delay or prevent account withdrawals or redemptions. Past performance is not a reliable indicator of future results. If the currency in which the past performance is displayed differs from the currency of the country in which the investor resides, then the investor should be aware that due to the exchange rate fluctuations the performance shown may be higher or lower if converted into the investor’s local currency. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer companies at the time of publication. The data used is derived from various sources, and assumed to be correct and reliable at the time of publication. The conditions of any underlying offer or contract that may have been, or will be, made or concluded, shall prevail.

The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted; except for the case of explicit permission by Allianz Global Investors GmbH.

AdMaster 1234992

© 2020 Allianz Global Investors

Active is: Investing with conviction

US elections: race is far tighter than expected – again

Summary

While the results are not yet final, the 2020 US presidential race is much closer than the polls and betting markets predicted. Investors should expect some flight-to-safety response in areas like US Treasury bonds and the dollar, and technology may perform well if President Trump secures victory again.

Key takeaways

|