Active is: Anticipating what’s ahead

Is the ECB using a misguided inflation measure?

Summary

Inflation can significantly erode purchasing power, but the ECB may be underestimating the true increase in consumer prices by relying on a narrow measurement. Investors may want to ready their portfolios for a higher rate of real-world inflation in the euro zone, perhaps by employing an actively managed mix of equities, real estate and commodities.

Key takeaways

|

During his eight-year tenure, European Central Bank (ECB) president Mario Draghi adopted an unprecedentedly expansive monetary policy that included negative policy rates and large-scale asset purchases, and contributed to the containment of disinflation. His like-minded successor, Christine Lagarde, seems set to continue his approach.

But what if the ECB’s obsession with disinflation (a decreasing inflation rate) is flawed because it overlooks a key factor: owner-occupied housing costs? If this turns out to be the case, it could mean euro-zone interest rates will remain too low for too long, and bonds could be exposed to a hidden loss of purchasing power.

Inflation is in the eye of the beholder

Several prominent euro-zone inflation gauges have painted a picture of subdued price pressure for the past 10 years:

- Consumer prices, as measured by the harmonised index of consumer prices (HICP) – the preferred inflation measure of the ECB – rose by an average of 1.3% per year.

- The core inflation rate – excluding energy, food, alcohol and tobacco – rose by 1.1% per year.

- Both of these measurements significantly undershot the ECB’s inflation objective of “below, but close to 2%”.

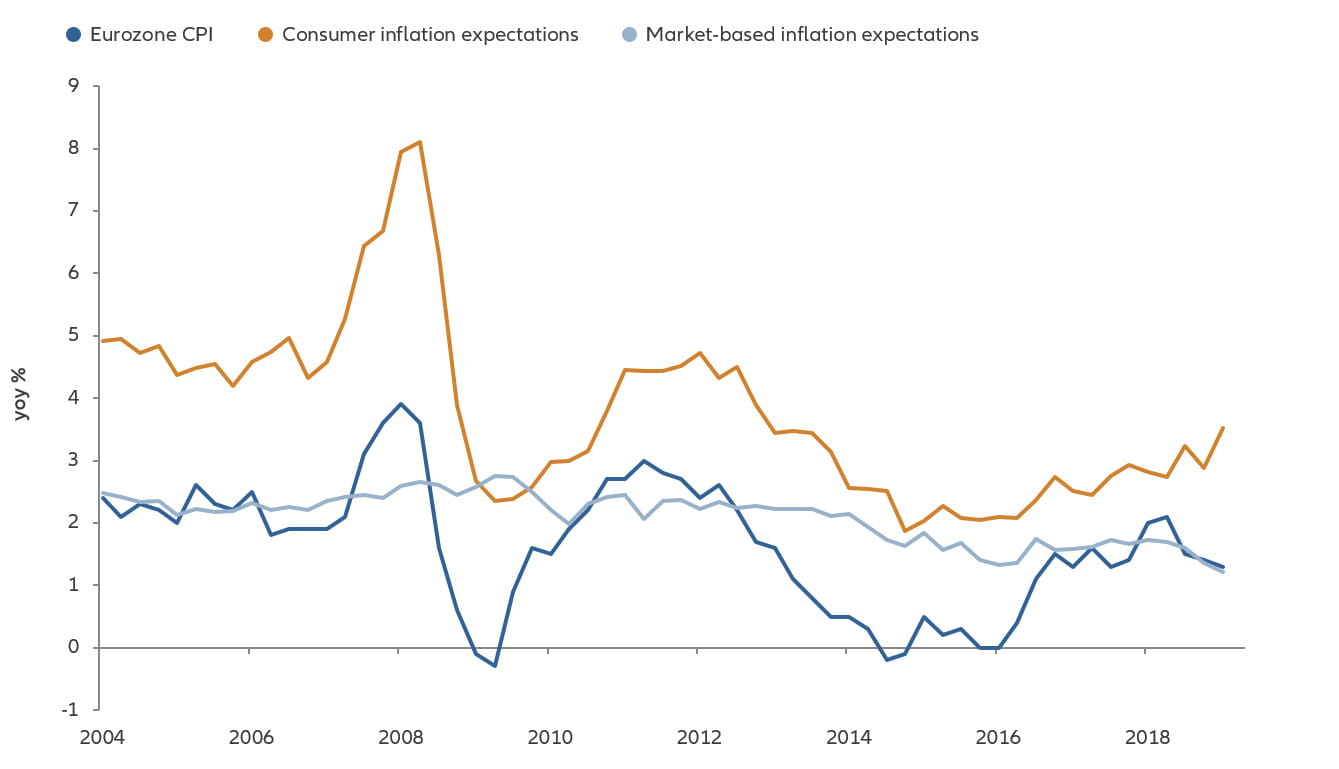

Longer-term market-based inflation expectations have responded accordingly and dropped to new historical lows. But this “lowflation” perception has not been shared by euro-zone consumers, whose inflation expectations have consistently outpaced official measures (see Chart 1).

Chart 1: euro-zone consumer price inflation and inflation expectations

Source: Bloomberg, European Commission. Data as at June 2019.

Part of this gap is caused by official price measures underrepresenting lower- and middle-income households, who tend to face higher-than-average inflation due to their consumption patterns. These households tend to spend a higher share of income on “frequently purchased items” like food, beverages and fuel, which are likely to be subject to stronger price increases. However, additional factors may also be at work.

Disregard of owner-occupied housing costs

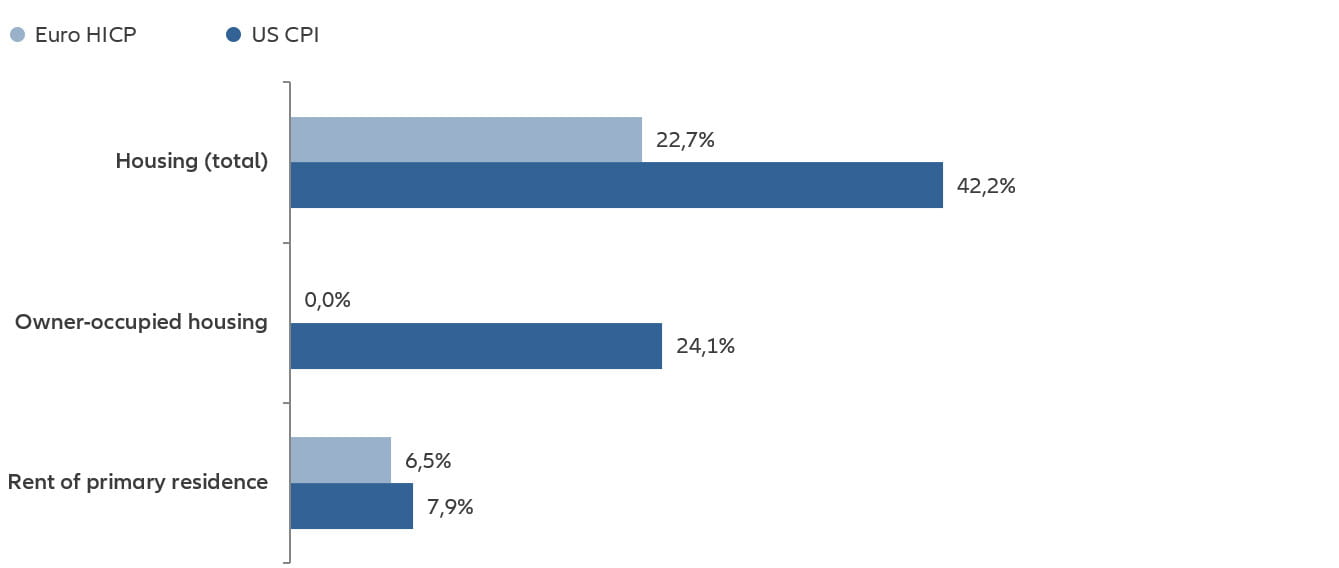

The most important reason for a potential underestimation of real-world price pressure by the HICP has been that it does not factor in owner-occupied housing costs. Compared with many other countries, most notably the United States, these and other housing costs in the euro-zone index appear significantly underrepresented (see Chart 2).

Chart 2: consumer price indices – item weights

Source: US Bureau of Labor Statistics, Eurostat. Data as at August 2019.

Why are housing costs being excluded? The European Commission (EC) reviewed this topic in 2018 and – with the full backing of the ECB – cited two major factors:

- Because the HICP must cover actual monetary transactions of household final consumption expenditures only, extending its scope would lead to a highly controversial integration of asset prices in an index that should only reflect changes in goods and services prices.

- The available data about housing costs do not fulfil Eurostat’s required standards of frequency and timeliness.

Downward inflation bias

We believe the EC’s reasons for excluding owner-occupied housing from the HICP are questionable – and they can still be addressed:

- While residential property represents a grey zone between a long-lived asset and a service that provides shelter, we believe that buildings and structures (but not land) should be treated in line with other durable consumer goods (like cars or furniture) that provide utility over multiple years.

- The current lack of timely availability of a comprehensive dataset should not justify the omission of all homeowner shelter costs. As with other economic indicators, Eurostat could solve this problem by using a flash estimate based on a sample of preliminary data.

Inclusion of owner-occupied housing (OOH) costs – which rose by 3.4% year-over-year in the first quarter – would have significantly lifted the recent euro-zone inflation trend (see Chart 3). Assuming the same share as in the US consumer price basket, headline HICP inflation would have run at an annual rate of 1.9% instead of 1.4%. In addition, the core rate in March 2019 would have been 1.6% instead of 0.8%.

Chart 3: euro-zone core HICP

Potential impact of owner-occupied housing costs

Source: Bloomberg, Eurostat, Allianz Global Investors’ own calculations. Data as at March 2019.

Aside from housing costs, other factors may have contributed to the understatement of euro-zone inflation. For example, many durable goods have shorter life spans (a negative quality effect results from higher obsolescence), and items such as apparel undergo frequent fashion changes that can distort their prices. Eurostat has been ignoring these factors, which would otherwise have lifted inflation. At the same time, Eurostat has been accounting for other factors – such as quality-improvements – that dampen inflation.

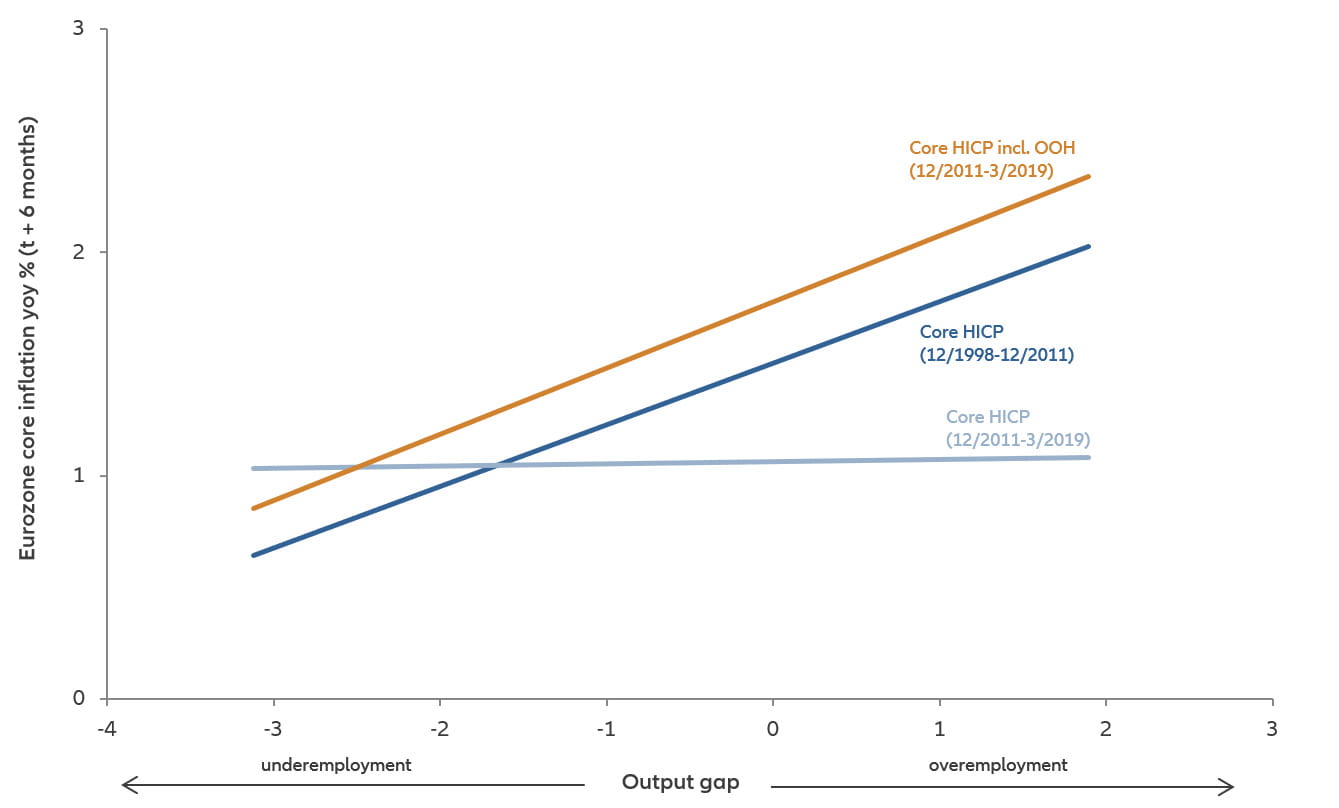

While the appropriate weight is certainly up for debate, it is clear that completely excluding OOH has pushed down official measures of consumer inflation. For example, one of the things that has puzzled economists is that inflation in the euro zone hasn’t risen as expected given the lower levels of unemployment. This can be measured by the price Phillips curve – the relationship between labour-market slack and inflation – which has been surprisingly flat. The inclusion of OOH costs would go a long way towards explaining that phenomenon (see Chart 4).

Chart 4: euro-zone price Phillips curve

Not as flat as it seems if homeowner shelter costs are included

Source: Bloomberg, Eurostat, OECD, Allianz Global Investors’ own calculations. Data as at March 2019. Output gap = NAIRU (non-accelerating inflation rate of unemployment) – actual unemployment rate.

What underestimating inflation means for monetary policy

The reliance on a narrowly defined and downward-biased inflation measure has contributed to the ECB adopting its ultra-expansive monetary policy with real-world impacts. Deposit rates are negative, and over the last five years there has been an unprecedented flood of liquidity from quantitative easing.

But worryingly, by maintaining this expansive stance, policymakers may have missed the opportunity to regain some wiggle room by starting to normalise policy. Moreover, the ECB’s reluctance to move away from its monetary-crisis mode has severely undermined its credibility and independence. This has given rise to fears of fiscal dominance, where monetary policy will be increasingly subordinated to fiscal-financing requirements.

More subtly, by repeatedly drawing attention to low consumer price pressures and undershooting its price stability target, the ECB has helped erode longer-term inflation expectations of investors and economists. This has raised the risk that a more general disinflationary mindset could become a self-fulfilling prophecy over time.

The answer may be for the ECB to adopt a more inclusive inflation approach, which would help the central bank to do two important things:

- Meet its objectives by capturing real-world inflation. Owner-occupied housing costs are highly sensitive to changes in monetary policy, so including them in price measures would lower the probability of a sustained over- or undershooting of the inflation target.

- Contain financial stability risks by strengthening the link between macroprudential policy and monetary policy. The rise in global asset prices over the past decade has been helped by unorthodox monetary policy, but the ensuing financial stability risks were primarily addressed by macroprudential policies such as countercyclical capital requirements or leverage caps for banks. Given that real-estate excesses have historically helped trigger financial crises, factoring housing costs into inflation measures would encourage the ECB to act pre-emptively with macroprudential and monetary-policy measures (commonly known as “leaning against the wind”) in times of a rapidly rising or falling real-estate market.

Beware “stealth devaluation” and rising financial-stability risks

The understatement of “true” inflation by official price measures is having far-reaching repercussions for investors, since bonds and other nominal assets could be exposed to a hidden loss of purchasing power. This “stealth devaluation” could aggravate the negative effects of financial repression, which helps governments reduce their real debt burdens but hurts savers.

Accordingly, investors should consider making an appropriate strategic allocation to an actively managed blend of real assets such as equities, real estate and commodities, which may be able to provide a proper inflation hedge and a means of diversification.

By continuing to focus on the incomplete HICP measure, the ECB faces an elevated risk of missing its official inflation target for several more years, despite running an overly expansive monetary policy. Against this backdrop, investors should be braced for a prolonged period of negative interest rates accompanied by rising financial-stability risks.

Further reading

For more on this topic, read “The risks of relying on an inaccurate inflation measure” (a more in-depth version is also available) and “The fairy tale of low inflation in the euro area”.

Hochstein, M. (2018). The Fairy Tale of Low Inflation in the Euro Area. The Economists’ Voice, 15 (1)

Investing involves risk. Bond prices will normally decline as interest rates rise. The impact may be greater with longer-duration bonds. Diversification does not ensure a profit or protect against a loss. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Panama, Peru, and Uruguay.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG, licensed by FINMA (www.finma.ch) for distribution and by OAKBV (Oberaufsichtskommission berufliche Vorsorge) for asset management related to occupational pensions in Switzerland; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.

968152

Active is: Investing for impact

As investor interest in impact investing grows, beware “impact washing”

Summary

Impact investing is becoming more popular, but investors keen to get involved should look out for traditional investments mislabelled as “impact”.

Key takeaways

|