Summary

A relatively new metric called the financial cycle can help tell investors more about an economy’s medium-term strength than the business cycle. The financial cycle can illuminate risks worth taking or avoiding, helping investors be more selective and active at a time when passively accepting risk may be detrimental.

Key takeaways

|

Has the global economy once again become overloaded with debt? More than 10 years on from the financial crisis – which was, at its core, a debt crisis – there are signs that indebtedness is reaching worrisome levels. Our research shows that global leverage for all sectors stands at 298% of world GDP, which is close to the all-time high of 303% set in 2009. That’s significantly higher than the 279% level set in 2006, on the eve of the financial crisis.

Yet high leverage alone isn’t the only factor that can hurt an economy. What’s more telling is how debt and asset prices interact in a kind of feedback loop that occurs when the private sector’s easy access to credit pushes up asset and property prices. This raises the value of the underlying collateral, which increases the amount that can be borrowed. The process continues to repeat until some event throws it into reverse – at which point credit can dry up and asset and property prices plunge. What’s more, the outstanding debt can linger for years, further dragging down growth.

Why “financial cycles” matter

This self-reinforcing process is at the heart of the concept of the “financial cycle”, which was developed by the Bank for International Settlements (BIS) after the financial crisis. It is different from the more commonly cited metric of the business cycle, which notes the ups and downs of real GDP. We think it’s an important metric:

- The financial cycle helps assess the medium- to long-term health of an economy by measuring the dynamics of private-sector (non-financial) debt and house prices.

- Financial cycles have generally expanded when private-sector leverage and house prices went up, and contracted when these factors went down.

- The average financial cycle is 16 years long (10 years of expansion and 6 years of contraction), while the average length of a business cycle is 5 years.

- In simplified terms, expanding financial cycles can indicate an economy in good health, but a contracting financial cycle can be a sign of economic distress.

We conducted our own research into historical financial cycles, covering 26 developed and emerging economies, and arrived at similar conclusions to the BIS. We found that during expanding financial cycles, higher home prices and greater access to credit have acted as tailwinds that helped economic growth. Recessions have still happened during times like these, as Chart 1 shows, but they tended to happen infrequently and were generally less deep and less long when they occurred. (However, we only analysed developed markets’ recessions, given the difficulty of defining recessions in emerging markets that have much higher long-term growth rates.)

This makes sense intuitively: houses are typically the biggest single asset of any household and are usually debt-financed. Accordingly, an expanding financial cycle indicates improving private household balance sheets and a generally growing economy, since those factors help people feel good enough about their finances to take on debt and buy homes. This shows why high levels of private-sector debt aren’t warning signs in and of themselves. The shallow recession in the US in 2001 is a good example of a short-lived recession during an expanding financial cycle.

Conversely, when house prices fell and banks constrained credit growth – that is, when the financial cycle contracted – recessions have tended to be deeper and longer. The financial crisis of 2007-2008 is the most severe version of a recession in times of a contracting financial cycle.

This brings us to another important finding: near the peak of a financial cycle, there seems to be an approximately two-thirds probability that a country will face a financial crisis – be it a banking crisis, sovereign-debt crisis or foreign-exchange crisis. In our analysis, all but two of the 36 recent crises we identified happened around the peak of their respective country’s financial cycle. This stands to reason, given that the peak of a financial cycle represents peak real-estate prices and debt levels – sometimes depicted as bubbles that inflate to unsustainable levels before they burst.

Chart 1: The financial cycle vs the business cycle

This non-representational graphic was built on our analysis of 26 economies since the 1970s to show the relationship between financial and business cycles. Financial-cycle peaks have been a warning sign for financial crises, while GDP growth has tended to be more stable when financial cycles are expanding.

Source: AllianzGI, Bank for International Settlements, The Economist, OECD, Datastream, IMF. Data as at 2018. Financial cycle is calculated as the average z-score of private non-financial debt/GDP (credit gap) and real house prices relative to trend. Financial-cycle calculations for 14 developed-market economies (US, UK, Germany, France, Italy, Netherlands, Spain, Portugal, Suisse, Sweden, Norway, Japan, Australia, New Zealand) and 12 (former) emerging-market economies (Brazil, Mexico, Turkey, Israel, Russia, China, Korea, Malaysia, Thailand, India, Singapore, Hong Kong) are since the 1970s or later, depending on data availability. Business-cycle analysis is for developed-market economies only. Data on recessions during different stages of the financial cycle indicate the average peak-to-trough move in real GDP and the average number of quarters of GDP below the previous cycle peak.

Where in the financial cycle are we today?

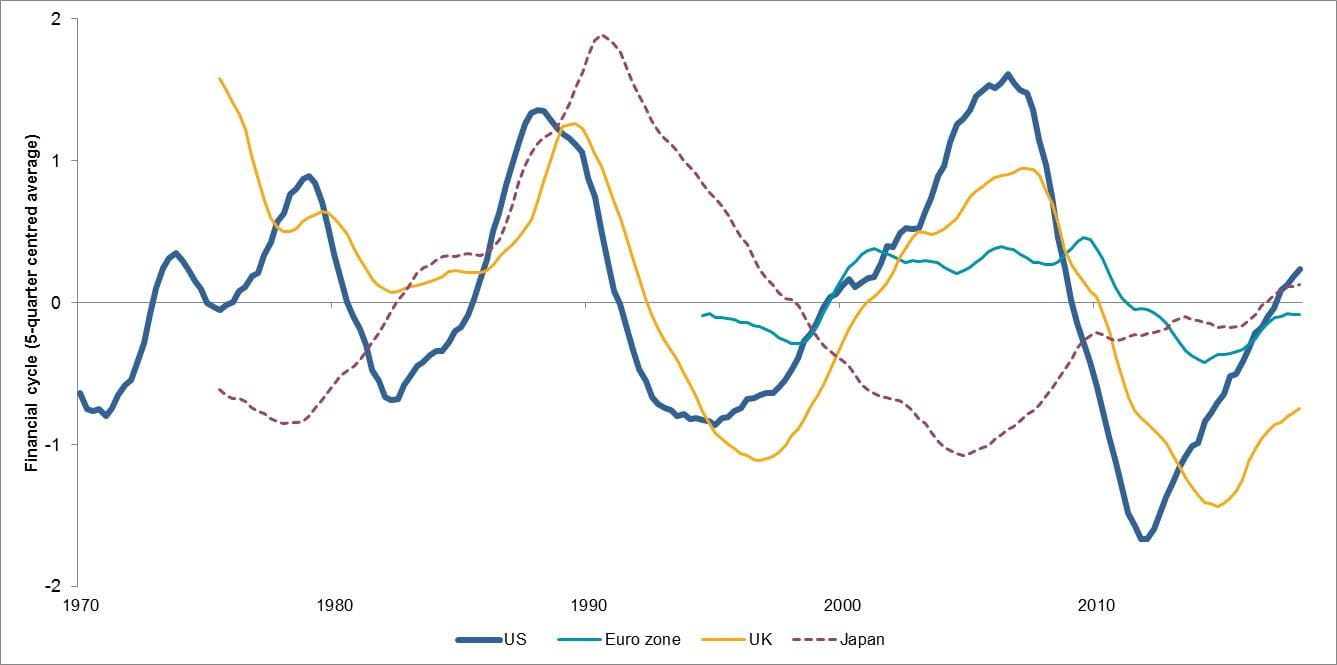

In developed economies, the financial cycle seems to be expanding in countries that either caused the financial crisis in the first place (the US, UK and euro zone) or that suffered severely (Japan), as Chart 2 shows. The financial cycle also appears to be expanding in New Zealand. Even though we can’t rule out a recession in the US, the euro zone , the UK or Japan in the coming one to two years – some of our models are indeed pointing at a rising recession risk – we believe that any recession there is likely to be moderate.

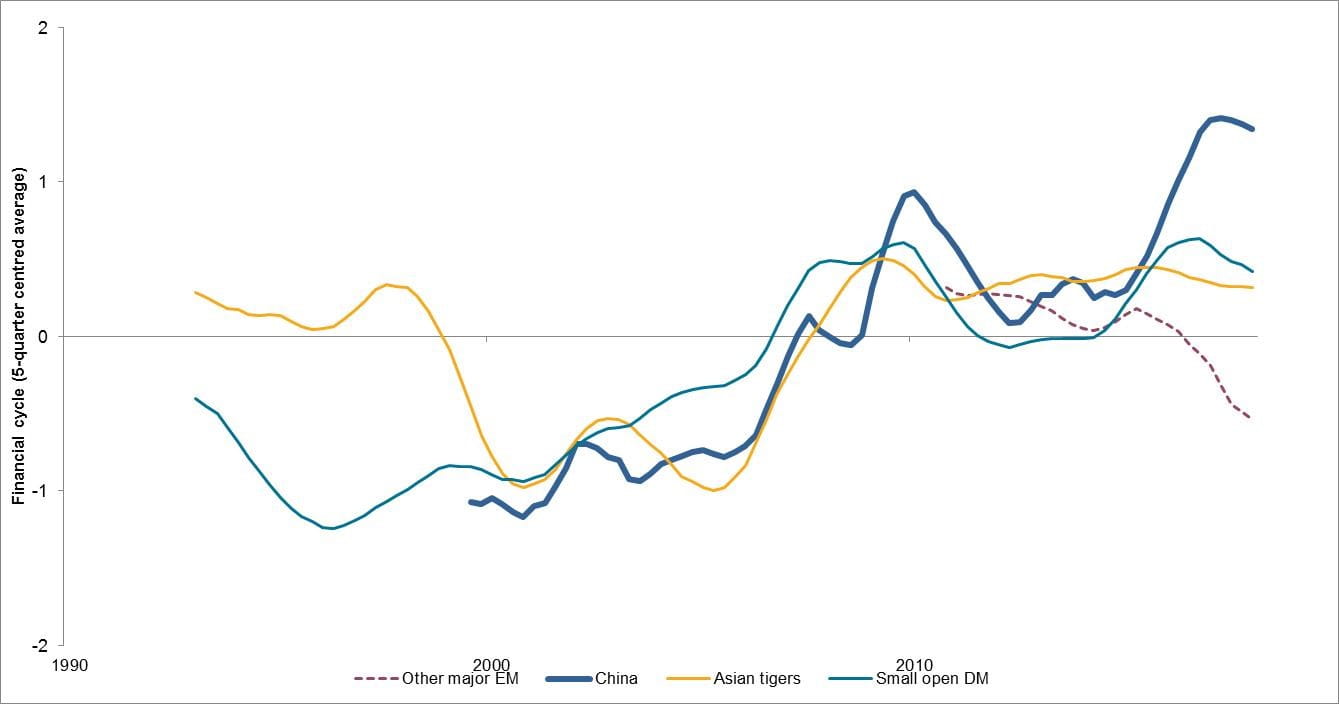

To the contrary, the financial cycle is near or just beyond peak levels in several Asian economies, including China, as Chart 3 shows. It is also near or just past its peak in small, open, developed economies that escaped the financial-crisis fallout a decade ago – notably Canada, Norway and Switzerland. (In Australia, the financial cycle peaked around five years ago.) Moreover, the financial cycle remains in decline in several major emerging markets (Brazil, Russia, India and Turkey) as well as in Sweden. We therefore expect to see structural headwinds for economic growth in these economies.

Chart 2: Financial cycles are expanding in major developed economies

Chart 3: Financial cycles are peaking or contracting in some developed and emerging markets

Source: AllianzGI, Bank for International Settlements, Datastream. Data as at Q1 2018. Financial cycle is calculated as the average z-score of private non-financial debt/GDP (credit gap) and real house prices relative to trend. Financial cycles of country groups are GDP-weighted averages of country-specific financial cycles: Europe is proxied by Germany, France, Italy, Spain, Netherlands, Portugal and Ireland; small open developed markets are proxied by Canada, Sweden, Switzerland, Norway, Austria and New Zealand; Asian tigers are proxied by Hong Kong, Singapore, Korea, Thailand; other major emerging markets are proxied by Brazil, Mexico, Russia, Turkey, Israel, South Africa, India. Financial-cycle calculations for 14 developed-market economies (US, UK, Germany, France, Italy, Netherlands, Spain, Portugal, Suisse, Sweden, Norway, Japan, Australia, New Zealand) and 12 (former) emerging-market economies (Brazil, Mexico, Turkey, Israel, Russia, China, Korea, Malaysia, Thailand, India, Singapore, Hong Kong) are since the 1970s or later, depending on data availability. Business cycle analysis is for developed-market economies only. Data on recessions during different stages of the financial cycle indicate the average peak-to-trough move in real GDP and the average number of quarters of GDP below the previous cycle peak.

Investment implications

For investors, the high debt levels seen in the world today remain an important risk to watch, both for economic growth and for financial markets. Yet high leverage isn’t the only factor worth monitoring; rather, it’s how debt and asset prices interact in the financial cycle that can help investors decide which risks are worth taking.

This is particularly important in times like these, when the biggest risk may be to take no risk. It also underscores the need to manage risk actively: a passive portfolio that merely tracks an index could be entering a difficult environment as the financial cycle contracts in the underlying economy. Active investing provides more than a defence against potential deteriorations in the global economy or regional ones: it also provides the chance to be proactive during periods of higher volatility and lower correlations.

Nevertheless, compared to the pre-financial-crisis period, the financial cycles of major developed economies seem to be in reasonably good shape this time around – a fact in which we take some comfort.

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted. This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG, licensed by FINMA (www.finma.ch) for distribution and by OAKBV (Oberaufsichtskommission berufliche Vorsorge) for asset management related to occupational pensions in Switzerland; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.

758566

Financial advisors do not view robo-advisors as competition

Summary

A new study featuring financial advisors in the US shows that they do not consider robo-advisors a serious threat, and most do not expect to make changes to their business to address them. Only a few have reduced fees or improved services to better compete.